Unknown Facts About Feie Calculator

Table of ContentsFacts About Feie Calculator UncoveredNot known Facts About Feie CalculatorAbout Feie CalculatorThe Basic Principles Of Feie Calculator 4 Easy Facts About Feie Calculator DescribedThe Basic Principles Of Feie Calculator Not known Facts About Feie Calculator

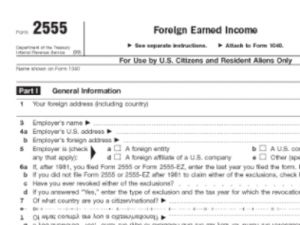

If he 'd regularly traveled, he would certainly rather complete Component III, detailing the 12-month period he met the Physical Existence Test and his travel background. Action 3: Coverage Foreign Earnings (Component IV): Mark gained 4,500 per month (54,000 each year).Mark computes the exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his salary (54,000 1.10 = $59,400). Considering that he lived in Germany all year, the percentage of time he lived abroad throughout the tax obligation is 100% and he enters $59,400 as his FEIE. Ultimately, Mark reports total salaries on his Kind 1040 and enters the FEIE as an unfavorable quantity on time 1, Line 8d, decreasing his gross income.

Selecting the FEIE when it's not the best alternative: The FEIE might not be perfect if you have a high unearned revenue, make even more than the exclusion restriction, or stay in a high-tax nation where the Foreign Tax Obligation Credit Scores (FTC) might be a lot more advantageous. The Foreign Tax Obligation Credit History (FTC) is a tax reduction approach frequently made use of combined with the FEIE.

Getting My Feie Calculator To Work

deportees to offset their united state tax obligation financial obligation with international earnings tax obligations paid on a dollar-for-dollar reduction basis. This indicates that in high-tax countries, the FTC can commonly get rid of united state tax obligation financial debt completely. Nonetheless, the FTC has restrictions on qualified taxes and the maximum claim amount: Qualified taxes: Only revenue tax obligations (or tax obligations instead of earnings tax obligations) paid to foreign governments are eligible.

tax responsibility on your foreign income. If the foreign tax obligations you paid surpass this limit, the excess foreign tax can normally be continued for approximately 10 years or returned one year (using a modified return). Preserving precise records of international income and taxes paid is therefore vital to calculating the proper FTC and keeping tax compliance.

expatriates to minimize their tax obligations. If an U.S. taxpayer has $250,000 in foreign-earned income, they can leave out up to $130,000 making use of the FEIE (2025 ). The remaining $120,000 may after that go through taxes, but the united state taxpayer can possibly apply the Foreign Tax obligation Debt to offset the taxes paid to the international nation.

10 Simple Techniques For Feie Calculator

He offered his United state home to establish his intent to live abroad completely and applied for a Mexican residency visa with his spouse to aid accomplish the Bona Fide Residency Examination. In addition, Neil secured a lasting residential property lease in Mexico, with plans to ultimately acquire a residential or commercial property. "I presently have a six-month lease on a residence in Mexico that I can extend another 6 months, with the purpose to get a home down there." Neil aims out that purchasing home abroad can be challenging without initial experiencing the place.

"It's something that people need to be actually attentive about," he states, and recommends deportees to be cautious of typical blunders, such as overstaying in the U.S.

Neil is careful to mindful to U.S. tax united state tax obligation "I'm not conducting any business in Service. The U.S. is one of the couple of countries that taxes its people no matter of where they live, implying that even if a deportee has no income from U.S.

Feie Calculator - Questions

tax returnTax obligation "The Foreign Tax obligation Debt allows people working in high-tax nations like the UK to counter their United state tax obligation liability by the amount they've currently paid in taxes abroad," claims Lewis.

The possibility of lower living expenses can be appealing, but it frequently includes trade-offs that aren't immediately obvious - https://www.indiegogo.com/individuals/38701518. Real estate, for instance, can be much more budget friendly in some countries, yet this can indicate endangering on framework, safety and security, or access to dependable energies and solutions. Affordable buildings may be situated in locations with irregular web, restricted mass transit, or unreliable healthcare facilitiesfactors that can dramatically affect your daily life

Below are some of the most often asked inquiries concerning the FEIE and other exemptions The Foreign Earned Revenue Exclusion (FEIE) enables U.S. taxpayers to omit up to $130,000 of foreign-earned revenue from federal income tax, minimizing their united state tax obligation responsibility. To receive FEIE, you must satisfy either the Physical Existence Test (330 days abroad) or the Bona Fide Residence Test (confirm your primary residence in an international country for an entire tax obligation year).

The Physical Existence Test needs you to be outside the U.S. for 330 days within a 12-month duration. The Physical Visibility Examination also calls for U.S. taxpayers to have both a foreign helpful resources earnings and a foreign tax obligation home. A tax home is defined as your prime place for business or employment, no matter your family members's house. https://www.reddit.com/user/feiecalcu/?rdt=34074.

Feie Calculator - Questions

A revenue tax obligation treaty in between the U.S. and an additional nation can help stop double tax. While the Foreign Earned Revenue Exclusion lowers gross income, a treaty may supply extra benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a needed declare U.S. citizens with over $10,000 in international financial accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation consultant on the Harness platform and the creator of The Tax Man. He has over thirty years of experience and currently focuses on CFO solutions, equity payment, copyright taxation, marijuana taxation and divorce related tax/financial preparation issues. He is a deportee based in Mexico.

The international made income exclusions, often referred to as the Sec. 911 exclusions, exclude tax obligation on salaries made from working abroad. The exemptions consist of 2 components - a revenue exemption and a housing exclusion. The complying with Frequently asked questions review the advantage of the exclusions including when both spouses are expats in a basic way.

The Only Guide to Feie Calculator

The tax obligation advantage leaves out the earnings from tax obligation at bottom tax rates. Previously, the exemptions "came off the top" decreasing income topic to tax obligation at the top tax prices.

These exclusions do not exempt the earnings from US taxation but just supply a tax obligation reduction. Note that a bachelor functioning abroad for every one of 2025 who gained regarding $145,000 without any various other revenue will certainly have gross income minimized to absolutely no - properly the exact same answer as being "tax totally free." The exemptions are computed daily.

If you went to business conferences or workshops in the US while living abroad, income for those days can not be left out. For United States tax obligation it does not matter where you maintain your funds - you are taxed on your globally revenue as a United States person.